Here is Why Repsol (BME:REP) Can Handle Its Debt Responsibly

David Iben put it properly when he stated, ‘Volatility isn’t a danger we care about. What we care about is avoiding the everlasting lack of capital.’ It is solely pure to think about an organization’s steadiness sheet whenever you look at how dangerous it’s, since debt is usually concerned when a enterprise collapses. We are able to see that Repsol, S.A. (BME:REP) does use debt in its enterprise. However is that this debt a priority to shareholders?

What Threat Does Debt Deliver?

Debt assists a enterprise till the enterprise has bother paying it off, both with new capital or with free money circulate. If issues get actually dangerous, the lenders can take management of the enterprise. Nevertheless, a extra typical (however nonetheless costly) state of affairs is the place an organization should dilute shareholders at an affordable share value merely to get debt underneath management. In fact, loads of corporations use debt to fund progress, with none destructive penalties. Step one when contemplating an organization’s debt ranges is to think about its money and debt collectively.

Take a look at the alternatives and dangers throughout the XX Oil and Fuel trade.

What Is Repsol’s Internet Debt?

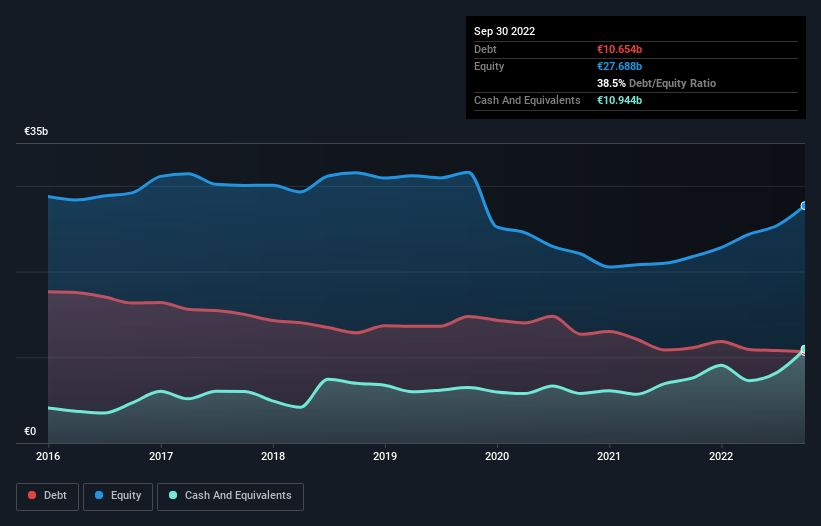

The picture under, which you’ll be able to click on on for better element, exhibits that Repsol had debt of €10.7b on the finish of September 2022, a discount from €11.1b over a 12 months. However it additionally has €10.9b in money to offset that, that means it has €290.0m web money.

How Wholesome Is Repsol’s Steadiness Sheet?

We are able to see from the newest steadiness sheet that Repsol had liabilities of €20.1b falling due inside a 12 months, and liabilities of €16.9b due past that. Offsetting these obligations, it had money of €10.9b in addition to receivables valued at €10.3b due inside 12 months. So it has liabilities totalling €15.8b greater than its money and near-term receivables, mixed.

This deficit is appreciable relative to its very important market capitalization of €19.5b, so it does counsel shareholders ought to keep watch over Repsol’s use of debt. Ought to its lenders demand that it shore up the steadiness sheet, shareholders would doubtless face extreme dilution. Regardless of its noteworthy liabilities, Repsol boasts web money, so it is truthful to say it doesn’t have a heavy debt load!

Much more spectacular was the truth that Repsol grew its EBIT by 159% over twelve months. That enhance will make it even simpler to pay down debt going ahead. The steadiness sheet is clearly the world to deal with if you find yourself analysing debt. However finally the longer term profitability of the enterprise will resolve if Repsol can strengthen its steadiness sheet over time. So should you’re centered on the longer term you’ll be able to take a look at this free report displaying analyst revenue forecasts.

Lastly, an organization can solely repay debt with chilly exhausting money, not accounting earnings. Repsol could have web money on the steadiness sheet, however it’s nonetheless fascinating to take a look at how properly the enterprise converts its earnings earlier than curiosity and tax (EBIT) to free money circulate, as a result of that can affect each its want for, and its capability to handle debt. Over the past two years, Repsol produced sturdy free money circulate equating to 57% of its EBIT, about what we might anticipate. This chilly exhausting money means it will possibly scale back its debt when it desires to.

Summing Up

Whereas Repsol does have extra liabilities than liquid property, it additionally has web money of €290.0m. And we preferred the look of final 12 months’s 159% year-on-year EBIT progress. So we aren’t troubled with Repsol’s debt use. The steadiness sheet is clearly the world to deal with if you find yourself analysing debt. Nevertheless, not all funding danger resides throughout the steadiness sheet – removed from it. Living proof: We have noticed 3 warning indicators for Repsol you need to be conscious of, and 1 of them should not be ignored.

If, in spite of everything that, you are extra all in favour of a quick rising firm with a rock-solid steadiness sheet, then take a look at our record of web money progress shares directly.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not Repsol is doubtlessly over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Have suggestions on this text? Involved concerning the content material? Get in contact with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We intention to convey you long-term centered evaluation pushed by elementary information. Word that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Supply hyperlink